Book Demo Here

"After a 4-minute questionnaire, I accessed a list of funding options and financial solutions tailored to my needs"

Business Grants

Maximise your opportunities with our expert grant-finding services. We specialise in sourcing and securing the most relevant business grants and funding opportunities tailored to your needs. Let us streamline the grant application process and connect you with the ideal financial support to help your business thrive.

SBA(7) and SBA Express Loans (USA)

Access and compare SBA-approved lenders and their proposals through our platform. Foundy’s comprehensive list of USA-accredited lenders is designed to help you find the best options. Start by completing our USA questionnaire to connect with top lenders and explore tailored financing solutions as part of the US government-backed SBA loan initiative.

How To Get Funded Step By Step

1

2

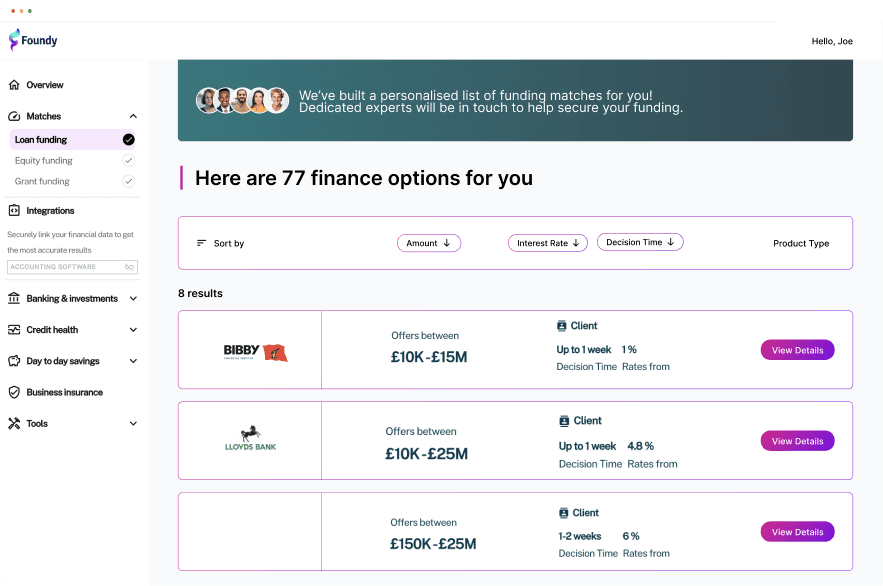

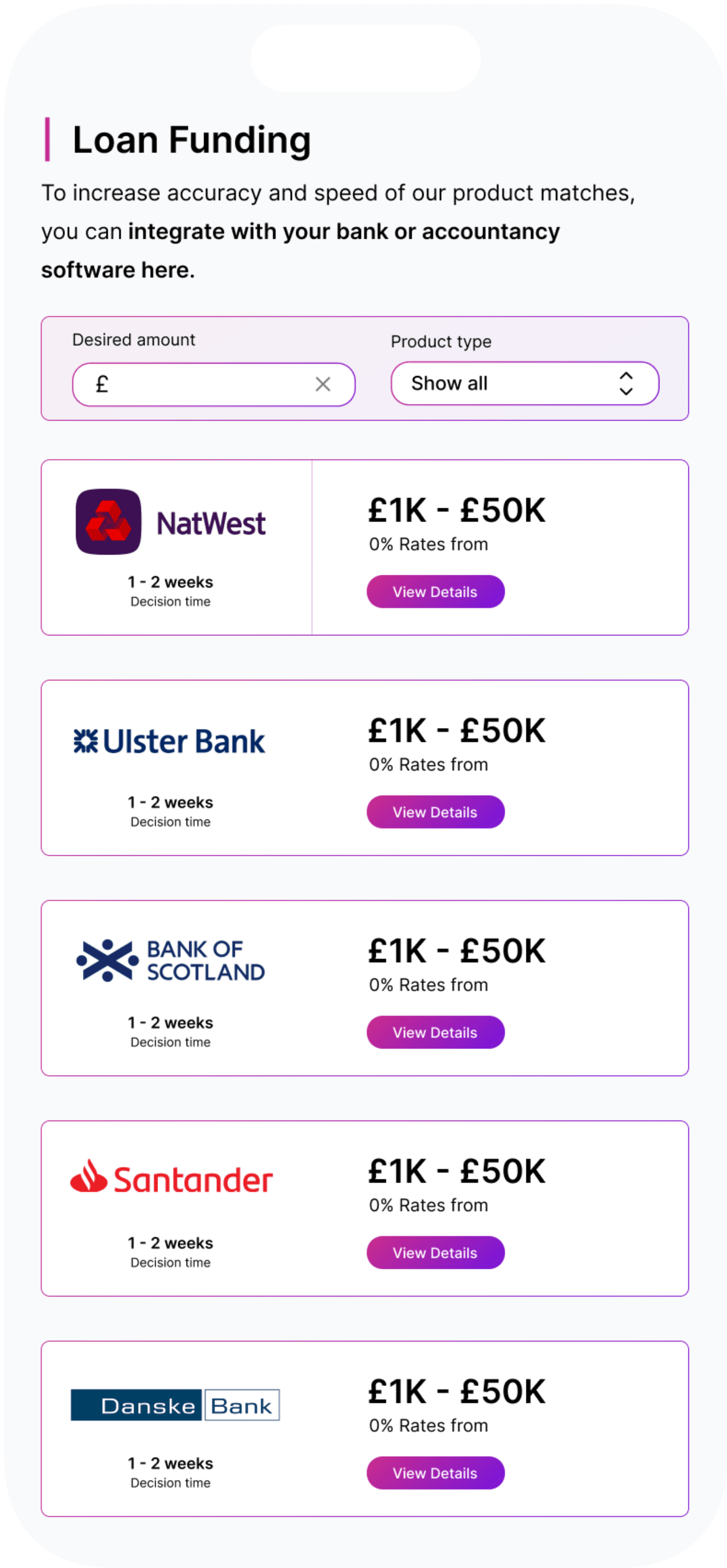

Complete Our Confidential Questionnaire

Complete the secure questionnaire to explore a variety of funding options. Once submitted, you’ll receive an email to verify your account. Our trusted fundraising technology is accredited by major banks in both the UK and USA, ensuring the highest standards of security and reliability.

3

4

Secure Capital

After adding deals to your account from your matches, please follow the steps outlined to provide the requested information. This is then reviewed by the lenders. It is often a quick process. For loan applications, below £1 million, lenders can have a decision for you between 24 hours to 7 days. However, for loans valued between £1m to £30 million, it can take between 2 weeks to 2 months.

SaaS

Ecommerce

Restaurants

Logistics

Construction

Manufacturing

Specialist Referral: we connect clients with our trusted fundraising partner, SF, who operates with integrity and is fully authorised and regulated by the Financial Conduct Authority (reference number 833145).

Please note, Foundy (BTB Holdings) does not offer regulated advice or act as a credit broker.

I am an acquirer, what is the process if my company has no trading history but I am buying an established business?

Is there a cost to use Foundy's platform? (Short answer: No, there is not. We save you money!)

How secure is the fundraising platform? (Short answer: Highly secure, adhering to ISO27001)

Can I get assistance throughout the funding process? (Short answer: Yes, absolutely)

If I register an account will there be a credit check before I can see the list of funding options? (Short answer: No there is not a credit check)

What are the steps for me to go through to secure funding? (Short answer: One quick questionnaire)

What information do I need to provide to get started?

What is the average time to receive capital from initial application to money in bank?

What type of business loans are available?

Book Demo Here