18%

3% in the last month

#1

business business broker

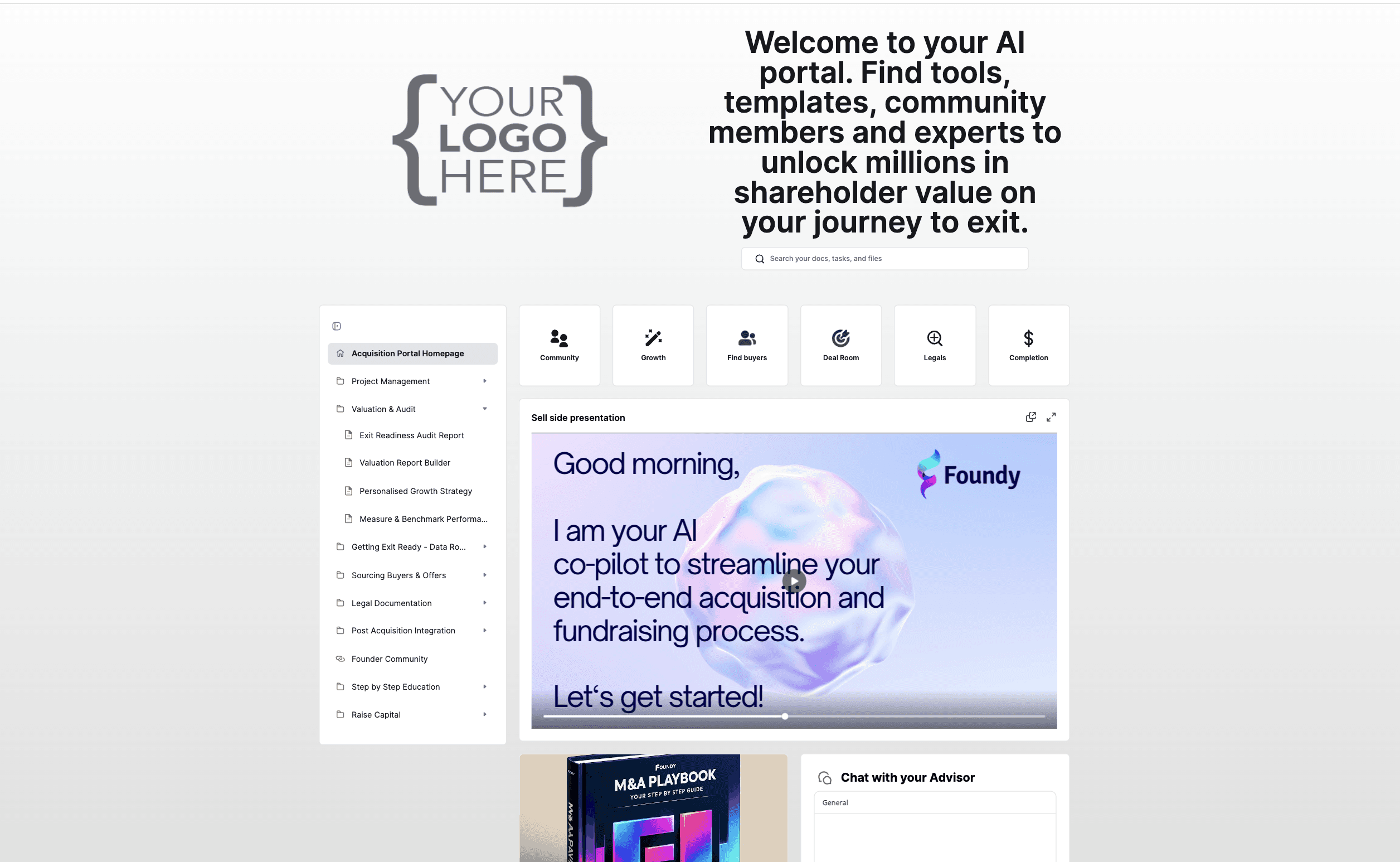

Foundy M&A advisor for businesses with between £/$200k to £/$25 million in annual revenue in the UK and North America

£32

Billion ($41B USD)

£2.8 billion ($3.6B USD) increase in

September 2024

of budget from active acquirers that have chosen to self register to Foundy's data base as they trust us for deal flow. These include strategic acquirers, family office investors, PE funds and individuals.

Before Foundy

87% of all businesses fail without providing ROI to shareholders

Years of hard work and lots of resources spent, yet your ROI remains unknown

Difficulties finding and vetting specialist advisors that know your industry well

Eye-wateringly high costs from advisors (brokers, lawyers, accountants, etc.)

Being at the mercy of advisors' response times and availability

Frustrating and fragmented communication channels with buyers and advisors

Long negotiations and limited specialised guidance creates risk of deals collapsing

Foundy’s AI and data-driven approach ensures you're on the most efficient path to a profitable acquisition.

Maximise valuation with specialised industry advisors, unlocking 7 figures in additional share value

Transparent and reasonable pricing with no surprise fees

Real-time access to seasoned experts means you’re never left waiting, speeding up negotiations and responses

All your advisors and communications in one centralised deal management platform, making the process smooth, predictable, and efficient

We drive the negotiation, ensuring you close faster and on more favourable terms, mitigating risks to valuation.

Technology (inc. SaaS)

Retail (inc. Ecommerce)

Healthcare

Energy

Industrial and Manufacturing

Financial Services

Consumer Goods

Real Estate

Media and Entertainment

Transportation and Logistics

Professional Services

Chris West

Acquired a Business via Foundy

“I found that Foundy was super easy to use and navigate. Being able to just have contact with a seller immediately was brilliant. You've got everything in your control and you can keep tabs on who you've made contact with, who's responded, what stages you're at in terms of conversation. And that's what sold me to carry on using Foundy as the platform I wanted to buy a business from. It's absolutely something I'll continue to keep publicising because I've had such a great experience. And personally, because I want to keep buying businesses, I will use Foundy again and again, providing I find the right business on the platform.”

Misha Jessel-Kenyon

Investor in Foundy

"The UK is crying out for something like Foundy. Nowhere else can I get access to dealflow like this for high quality businesses."

Jennifer Claire

Sold a Business via Foundy

“Partnering with Foundy was very valuable. Our advisor was highly experienced in online business M&A. He provided expertise that was pivotal in securing a successful acquisition deal. The team not only understood my vision but also expertly navigated the complexities of our industry niche which was essential in maximising the value of my business.”

Nikki Wheeldon

Sold a Business via Foundy

"I successfully sold my company via Foundy. I recommend Foundy now to almost everyone I can. It's not just a platform where you list. It's not just a service that helps you to sell. There are extra services that can help you with how to do your valuation and how to make sure you've got a data room that looks good and has everything that you need in there and looks professional. They help you look like you know what you're doing and you're able to just roll that out to the people that are interested. This makes the whole process so much easier."

George Stock

Sold a Business with Foundy

"I sold my business via Foundy in 25 days. The sign-up process was easy and we received messages from 8 interested buyers within a week of listing."

Jamil Khan

Bought a Business via Foundy

"I completed an acquisition of an e-Commerce management agency via Foundy. I've bought businesses from other sites previously, but my Foundy experience was by far the best yet! I was able to acquire a business that met all my criteria in less than a month, and the team were really helpful and great to work with. I'd recommend Foundy to anyone looking to buy a business."

Will Oswald

Financial M&A Advisor at Foundy

"Foundy is an exceptional platform for both buyers and sellers. It offers an easy and quick way to interact directly with business sellers, and you can access all the relevant data, information, PDFs, and data rooms instantly, making the due diligence process seamless. This is a game-changer compared to traditional M&A advisory firms, which are often time-consuming and cumbersome. Foundy connects you directly with business sellers or buyers, depending on your needs, and their transaction fees are also 50% lower than those of traditional firms. It's an incredibly efficient and cost-effective solution."

Anthony Weiss

Used Foundy's services

"My co-founder and I had a great call with Joe at Foundy. He shared tailored tips and insights which have been valuable to our exit process. Selling a business is complex and fragmented so the portal is a valuable platform to centralise the tools founders need to sell their business. It is otherwise difficult, especially whilst running the business."

Sellers

Suitable for business owners and leaders who are 1 to 36 months away from a business sale

Deal Execution Advisory Services (selling in the near term)

Secure offers and successfully navigate the transaction process to complete a deal

Designed for business owners ready to sell in the near term, this package maximises your sale outcome. Your dedicated advisory team handles the entire sale process with a highly personalised approach.

Valuation & Sale Readiness: Get a comprehensive valuation and readiness score based on data from over 1 million transactions, ensuring you’re positioned to engage buyers effectively.

Presentation & Marketing: We take care of the heavy lifting by preparing teaser summaries, buyer lists, and information memorandum materials that present your business optimally - different to the approach needed for a funding round.

Targeted Buyer Outreach: Our AI platform connects you with qualified buyers from our extensive database, ensuring your business reaches the right audience.

Expert-Led Negotiation & Closing: Our advisors handle negotiations, and recommended lawyers will assist in securing the best terms, allowing you to stay focused on running your business.

Risk Mitigation: Foundy’s triangular model - AI, advisors, and market data - helps anticipate risks and accelerate the deal process.

Deal Completion: We guide you through the final stages, ensuring the sale is completed efficiently and securely.

Long Term Transaction Planning Package (6 to 36 months until your intended exit event)

Your Step By Step Path To Achieve A Successful Exit

Personalised onboarding

Get Ready For A Transaction

Receive a detailed Valuation Report and an Exit Readiness Score.

Get a step-by-step roadmap and support to organise your data room

Our team helps you optimise your business to attract the best buyers and maximise value.

We engage with a hand-picked list of qualified buyers from our network, ensuring relevance to your business.

Our advisors provide negotiation support to help you secure the most favourable terms.

Receive essential tools and strategies to prepare for buyer discussions.

5. Deal completion

Use your own lawyer or a suggested specialist and Legal tech AI tools to help you navigate legal documentation

The advisors and technology handle the process, to spot red flags and secure the best possible terms.

Successful Exit & Payout to Shareholders

Receive ongoing post-acquisition support to manage wealth and secure your financial future.

Join a network of successful founders who have exited their businesses and share valuable insights.

We understand that your exit is potentially a life changing event. Speak directly with Foundy's Founder about your long or short term goals

and how Foundy will tailor a solution accordingly.

Meet Some of Our Expert Team

Discover some of Foundy's team. Please note, this only represents a small portion of our team members, and does not include our industry specific specialists that support each client within their respective market niche. Lee Forster is one such specialist, supporting clients in the nutrition and bio technology market.

Joe Lewin | CEO

Joe Lewin founded Foundy.com to revolutionise M&A by addressing inefficiencies and reducing costs in the traditional sale process. Having worked on 16 successful acquisitions and having raised £1.5 million from investors, Joe leads a team that specialises in maximising exit value for business owners. His deep expertise in building buyer relationships and understanding the end-to-end sale process ensures sellers achieve optimal sale outcomes.

Before Foundy, Joe scaled and exited a SaaS marketplace, bringing hands-on experience in managing the complexities of growth and acquisition. It was clear that the acquisition process needed modernising so that other business owners could access the tools, support and network needed to complete a successful exit.

David Battey has over 20 years of M&A experience, helping businesses scale and secure high-value exits.

With a background managing portfolios at European Private Equity firms, David’s expertise lies in guiding clients through valuation, financial strategy, and ensuring optimal deal structuring.

At Foundy, he applies his experience to help businesses maximise deal outcomes and streamline their exit processes. David has deployed his extensive expertise to optimise Foundy's product and value proposition from end to end.

Mel Ragnauth | Director

Mel Ragnauth is a Chartered Accountant with extensive experience in scaling businesses and guiding companies through successful exits.

Mel studied Law at Cambridge University and previously led SpiritLat, a company he grew from 7 to 120 employees that featured on the Sunday Times Tech Track 100.

With over two decades of career experience, including working at PwC and Orbis, Mel has successfully managed both buy-side and sell-side transactions. He specialises in growth strategies, capital raising, and maximising shareholder value.

Connor O'Donnell | Analyst

Connor specialises in due diligence and buyer sourcing, ensuring that every client’s business is fully prepared for a successful acquisition.

With experience in financial analysis and investment strategy, Connor delivers accurate valuations and ensures sellers engage with qualified buyers.

At Foundy, he uses our AI-powered tools and market insights to prepare clients for their exit readiness journey, helping them navigate the key phases of negotiation and deal closing with confidence and precision.

Lee Forster | M&A Advisor

Lee Forster brings extensive experience in building, advising, investing in, and acquiring businesses. As an ex-Olympian, he has scaled multiple companies, including Neat Nutrition, leading acquisitions and exits himself and advising on many successful deals. Lee has M&A deal-making experience across an extensive number of sectors and industries. His specialist areas include healthcare, including verticals such as nutrition, biotechnology, and fitness tech, where he helps businesses grow, exit successfully, and maximise value.

With deep experience and a far reaching network across various industries, Lee supports business owners from valuation to deal execution, reducing risks and securing optimal outcomes.

Frequently asked questions

FAQs

Frequently Asked Questions from our Business Owners